Independent Expertise

Entrusting responsible financial education to independent experts minimizes risks and maximizes the benefits for your organization and customers.

Welcome to responsiblo, your gateway to promoting financial responsibility. See how our service empowers your customers and positions your brand as a leader in responsible practices.

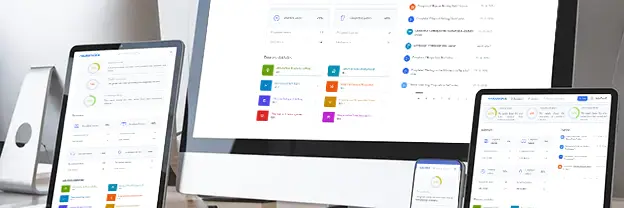

Responsiblo offers an interactive PaaS platform to educate clients of banks, lending institutions, and mortgage companies. Our mission is to bridge the gap between complex financial knowledge and everyday money management, giving your customers the tools they need to make informed financial decisions.

By using our platform, your institution can:

Improve Financial Responsibility

Promote Long-term Financial Stability

Build Stronger Relationships with Clients

Lead the Way in Responsible Financial Practices

Responsible money management is more critical than ever in today's fast-changing financial landscape. Educating consumers on financial responsibility is a moral obligation and a strategic advantage for businesses aiming for long-term success. Here's why focusing on financial responsibility matters:

Educated consumers make smarter financial decisions, reducing debt risks, financial stress, and insolvency.

Proactively educating consumers about responsible money management shows regulators that your company is committed to social responsibility and reduces regulatory pressures.

A strong focus on public financial education improves your brand's reputation, making your company a leader in ethical business practices.

Promoting financial responsibility opens the door to innovative products and services that cater to evolving consumer needs, such as sustainable savings programs and low-interest loan alternatives.

Adapting to regulatory shifts and changing consumer preferences ensures your brand is prepared for future challenges in the financial sector.

Prioritizing financial education sets your company apart in a crowded market. It attracts consumers who value ethical and responsible business practices and fosters valuable partnerships.

Responsiblo goes beyond primary financial education, offering an entire ecosystem that empowers your brand to teach consumers about intelligent money management while enhancing your brand's credibility in the financial sector.

We provide a unique subdomain for your business (e.g., yourbrand.responsiblo.com), fully tailored to your brand's look and feel:

We collaborate with top financial advisors and industry professionals to ensure our platform delivers reliable and actionable content:

Our training modules are crafted to make learning about financial responsibility straightforward and impactful:

We ensure that the financial education platform remains up-to-date and relevant to users' needs:

Our platform provides the tools your company needs to foster a positive public image while ensuring regulatory compliance in the financial sector.

Engage your customers through an interactive and educational program that encourages responsible money management. Help them develop sustainable financial habits and avoid risky financial behaviors. Unlike other services, our solution directly targets your customers, offering personalized insights into their financial behavior thanks to our powerful analytics, evaluation, and monitoring tools. In an era of tightening regulations in the financial industry, responsiblo will equip your company with the knowledge and data necessary for a constructive dialogue with regulatory bodies.

We Are Here to Help Your Company with ESG and CSR Integrating our service into your company's operations is simple, transparent, and measurable. It benefits your brand and has a positive social impact by educating your customers on responsible money management. With responsiblo, you can stay ahead of unexpected financial risks and establish yourself as a leader in social responsibility.

Implementing a financial education platform is a critical investment in your company's future in the dynamic and heavily regulated financial services sector. Let's explore the benefits this approach can offer to your brand. Responsiblo also enables you to implement a unified communication strategy on responsible money management across all markets.

Providing objective, evidence-based information on financial responsibility and responsible money management demonstrates that your company takes its societal role seriously. Research published in The Journal of Consumer Affairs shows financial education programs can significantly improve brand trust.

Transparent communication about financial risks and benefits can enhance your brand's credibility. According to a study by PwC, 79% of consumers state that trust is a key factor in choosing financial services.

Active involvement in financial education can positively influence the perception of your brand among stakeholders. A report by The Economist Intelligence Unit revealed that investors viewed companies with strong CSR initiatives focused on consumer financial responsibility 18% more favorably.

A commitment to financial education can be a key differentiator in the competitive financial services industry. According to Forbes, companies that invest in promoting financial responsibility among consumers report an average of 12% higher customer retention.

Our platform adapts content to local needs and regulations while maintaining a consistent message about responsible money management. This approach can lower the cost of marketing communications while improving campaign effectiveness. On average, our clients see a 15-20% reduction in costs and a 10-15% increase in effectiveness.

Rapid updates in response to new financial knowledge or regulatory changes are crucial. Our platform enables content to be updated globally within hours, which traditionally takes weeks in the financial industry.

Whether through websites, social media, or direct emails, we ensure your message about responsible financial habits reaches your customers on their preferred channels. This integrated approach can increase the reach of your campaigns by up to 250% compared to isolated efforts.

From global events like Financial Responsibility Month to new product launches, responsiblo enables synchronized communication across all markets, amplifying the impact of your initiatives.

We designed responsiblo to prioritize ease of use and seamless integration. See how our platform can provide your organization with a cost-effective solution for delivering financial education to your customers.

Centrally managed content reduces the expense of creating and localizing educational material for different markets. Clients report savings of up to 60% by switching from decentralized approaches.

Our platform helps you achieve substantial cost savings by reducing your reliance on local agencies for content creation and campaign management. On average, our clients save 40-50% on external collaborations.

Your team can focus on higher-level strategic activities. Clients report up to a 30% increase in productivity for their marketing and communications teams after implementing responsiblo’s financial responsibility programs.

Expanding your financial education efforts into new regions or markets is made simpler and faster with responsiblo. Clients report 50% faster expansion compared to traditional methods.

We ensure the platform is fully operational within weeks, 70% faster than the average deployment time for similar solutions in the financial services sector.

Our intuitive interface allows for easy content management without the need for technical expertise. After just two hours of training, 95% of clients’ teams can handle platform administration effectively.

Automatic updates ensure the platform remains secure and up-to-date without requiring manual input, reducing security risks by 80% and keeping your content relevant.

Our dedicated technical support team is available 24/7, with an average response time of under 15 minutes, ensuring that any issues are resolved quickly and efficiently.

The platform provides detailed insights into user engagement and the effectiveness of your financial education campaigns, helping clients improve their tracking and optimization of educational initiatives by 40%.

Integrating responsiblo into your financial education strategy is designed to be quick, smooth, and efficient, ensuring minimal disruption to your operations.

We’ve streamlined the entire integration process to minimize the time and effort required from your team. Our goal is to deliver a fully functional platform within a typical timeframe of three weeks without interrupting your daily business operations. With responsiblo, you get a powerful tool for financial education almost instantly, with minimal impact on your internal resources.

* The average time of integration into the system of our customers may vary according to the diverse needs of the company

Responsiblo offers a unique combination of expertise, advanced technology, and flexibility, making us the ideal partner for your financial responsibility initiatives. Let's dive into what makes us stand out from the competition:

Join the leading financial institutions using responsiblo to power their financial responsibility programs. Our solution will help you:

During a 60-minute call with financial education experts, we will discuss your specific needs and goals to develop a customized solution.

We will present you with a detailed platform design that aligns with your business goals and branding within five working days.

We offer a 30-day pilot program where you can test our platform with a selected group of customers to measure its impact and effectiveness.

Once the pilot is approved, we proceed to full implementation, which typically takes 4-6 weeks for complete integration.

Our dedicated support team is available 24/7 to ensure smooth operations, maximize your return on investment, and continuously improve platform performance.

We are ready to answer your questions and help you implement a practical financial education strategy.